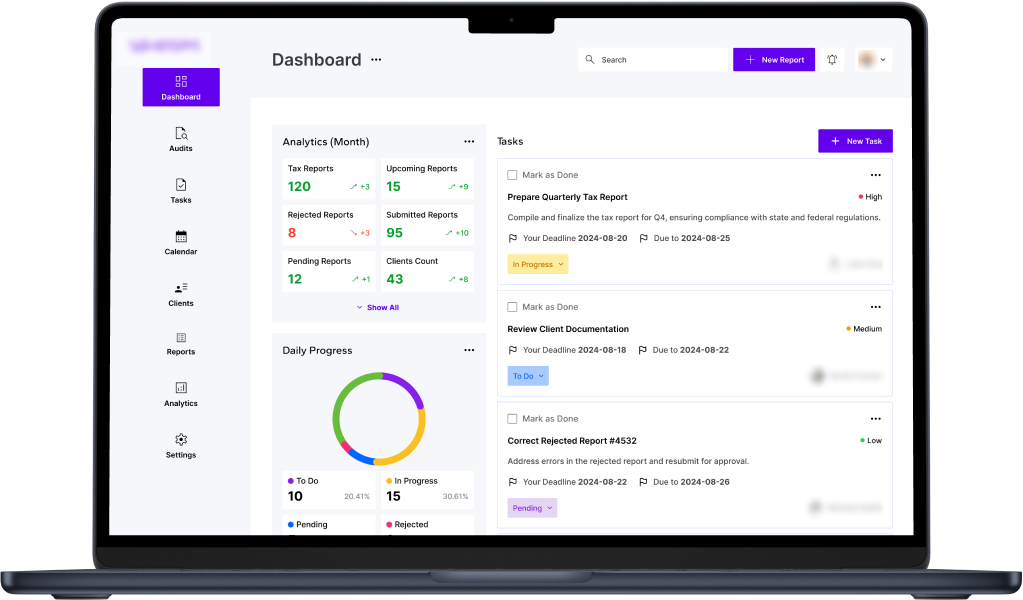

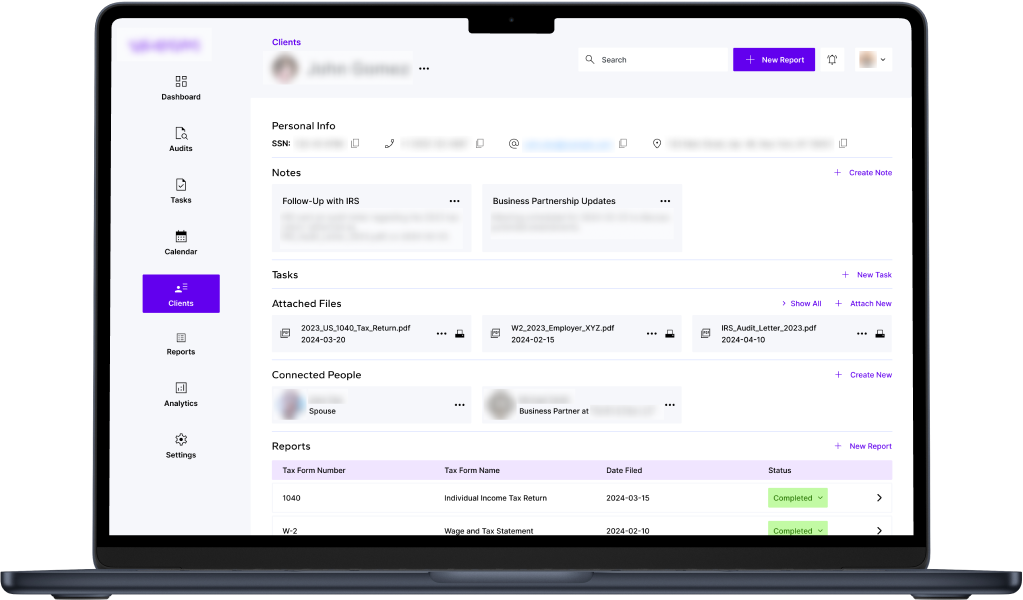

bART Solutions developed a high-performance .NET-based platform specifically designed to optimize large-scale tax data management for auditors. Leveraging MS SQL for secure and efficient data storage, the system processes millions of records with speed and accuracy. Real-time data validation through SignalR provides immediate feedback, alerting auditors to discrepancies instantly, while Protobuf ensures quick and reliable data transfer, even for large datasets.

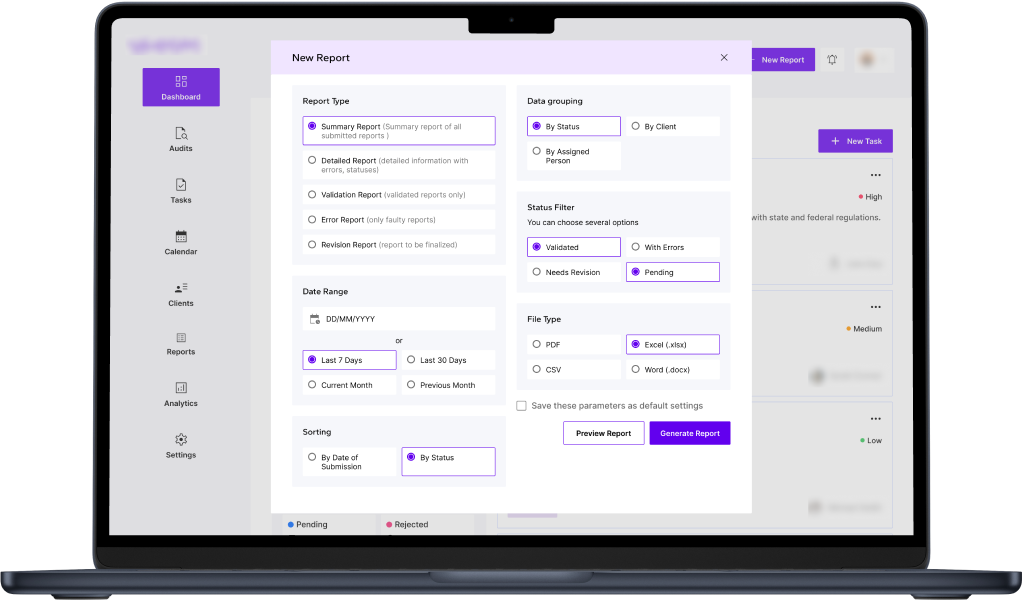

The platform includes automated PDF report generation, allowing auditors to produce ready-to-submit regulatory reports with minimal effort. An intuitive interface built in ASP.NET and Angular supports efficient navigation, enabling auditors to detect and correct errors swiftly. With extensive libraries integrated, the platform smoothly handles legacy data, ensuring that the client can access historical records with ease.

High-volume data processing capability

The platform’s processing engine is specifically designed to manage tax data and capable of managing vast datasets across various regulatory regions.

Adaptive rule-based validation

A flexible validation system applies thousands of tax rules tailored to specific regional requirements, such as ownership equity checks and exclusive tax exemptions.

Automated regulatory compliance updates

To maintain compliance, the platform integrates automated updates that synchronize with the latest tax laws across different regions.

Optimized data transmission

The platform leverages efficient data transmission protocols, ensuring rapid and secure data flow between components, even with high data volumes.