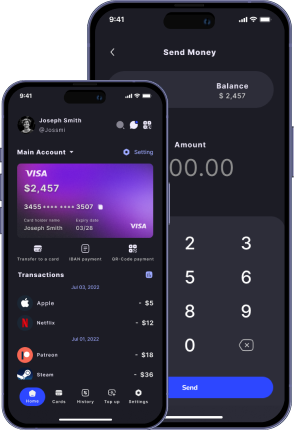

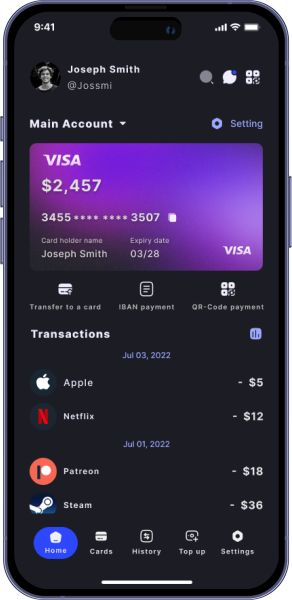

Personalized dashboards

The platform offers personalized dashboards, allowing users to configure widgets to display information such as recent transactions, account balances, and payment history. This customization enables users to tailor their interface to their specific needs, enhancing usability and efficiency.

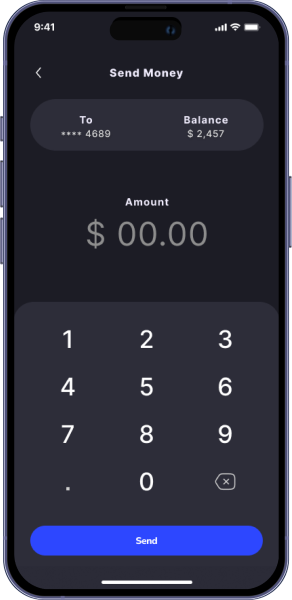

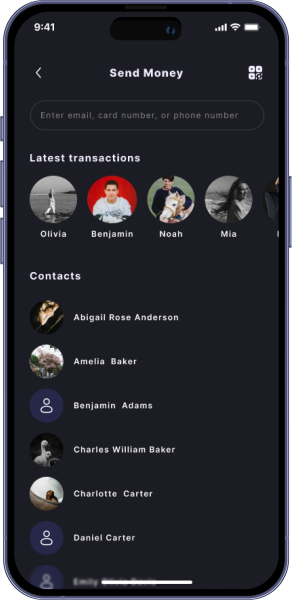

Quick payment options

Users can access quick payment options that streamline the transaction process. These features include saved payment methods, recurring payments, and one-click payments, making the payment experience fast and convenient.

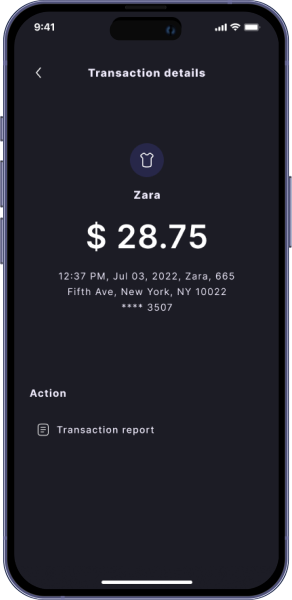

Detailed transaction history

The system provides users with detailed transaction history, including comprehensive records of past payments, dates, amounts, and transaction statuses. This feature allows users to easily track and manage their financial activities, ensuring transparency and accountability.

Real-time notifications

Real-time notifications keep users informed about their account activities and transaction statuses. Alerts for successful payments, pending transactions, and any suspicious activity help users stay updated and secure.

Secure authentication

The platform includes secure authentication features, such as multi-factor authentication (MFA) and biometric login options. These security measures ensure that only authorized users can access their accounts, enhancing the overall safety of the platform.

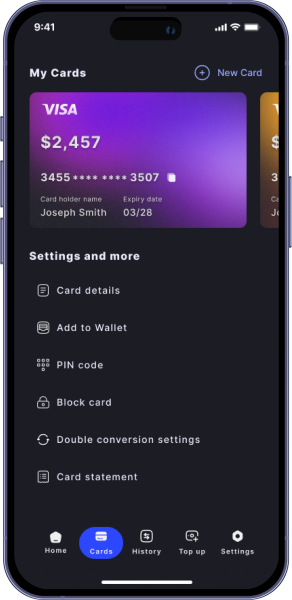

User account management

Users have access to robust account management tools, enabling them to update personal information, manage linked payment methods, and set preferences for notifications and security settings. This feature empowers users to maintain control over their account details and settings.

Custom reports

The system allows users to generate custom reports tailored to their specific needs. These reports can include detailed analyses of transaction patterns, spending summaries, and other financial metrics, helping users make informed decisions based on accurate data.

Multi-currency support

The platform supports multi-currency transactions, allowing users to make and receive payments in various currencies. This feature is particularly useful for users involved in international transactions, providing flexibility and convenience.

Customer support integration

Integrated customer support features enable users to access help and support directly within the platform. This includes live chat, support tickets, and comprehensive FAQs, ensuring users can quickly resolve any issues they encounter.

User feedback mechanism

The system includes a feedback mechanism that allows users to provide input on their experience. This feature helps the client continuously improve the platform based on user suggestions and feedback, ensuring the service evolves to meet user needs effectively.