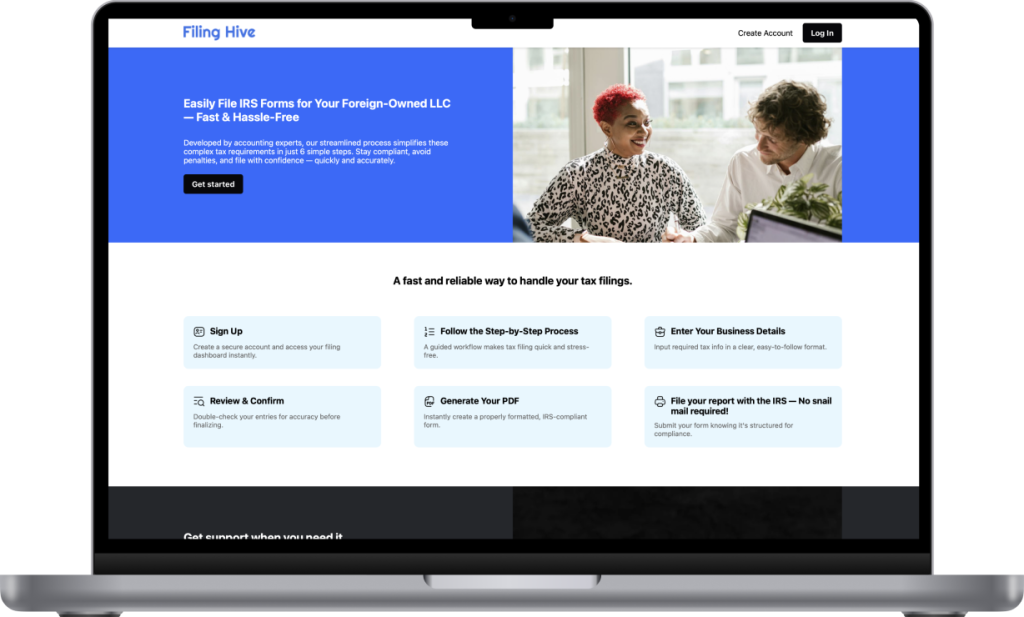

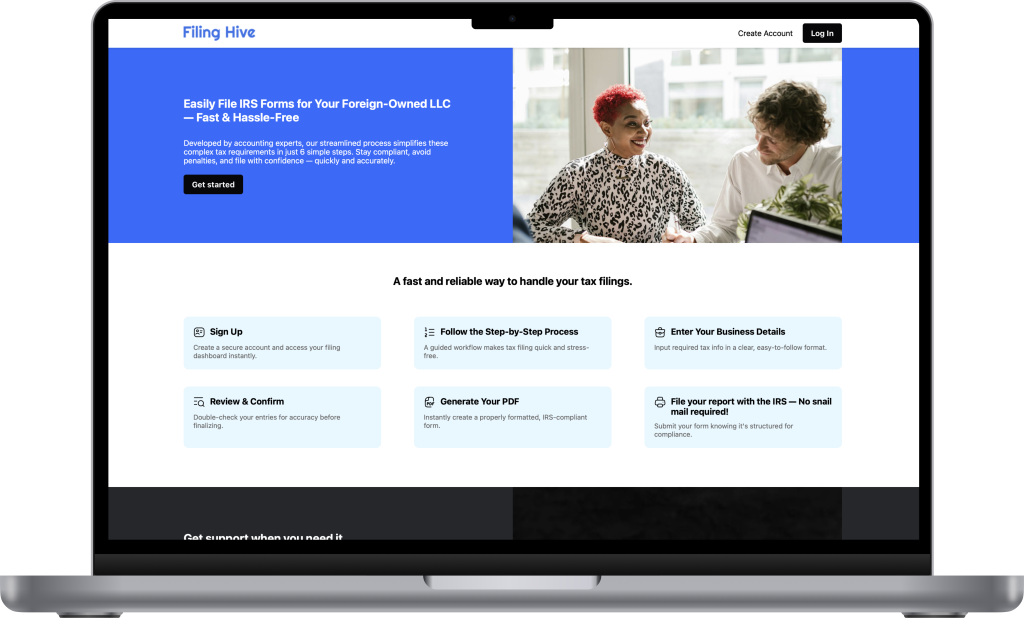

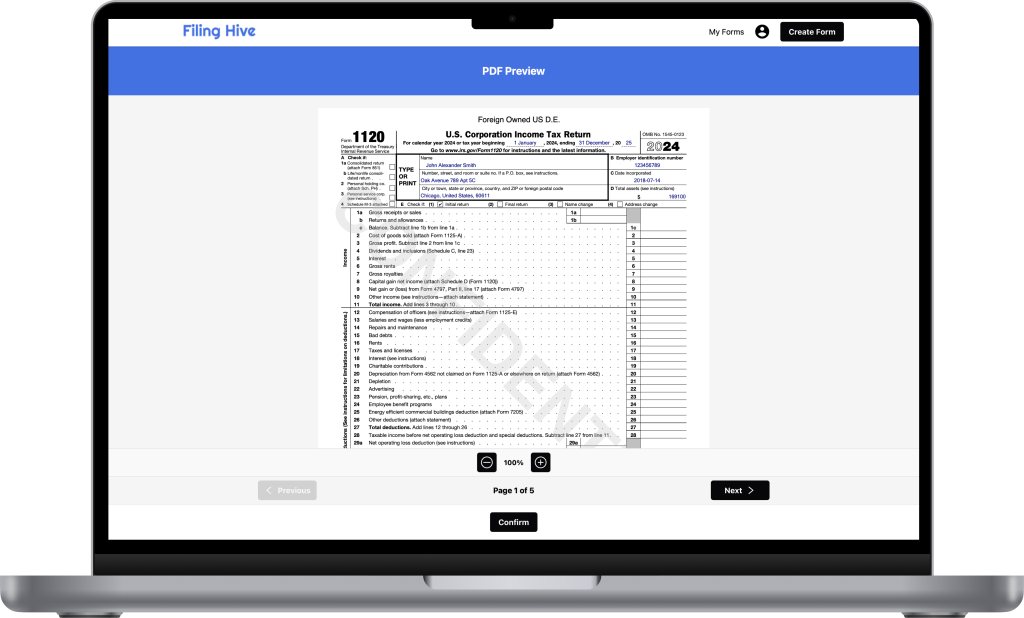

We delivered a cross-platform application that simplifies U.S. tax form preparation through a structured, step-by-step flow. Each section includes smart input validation and contextual hints, all reviewed by U.S. tax attorneys to ensure legal accuracy and clarity for users.

The system supports multiple form types, maps relationships between entities and stakeholders, and produces submission-ready outputs. It saves user progress automatically, syncs across devices, and provides a full audit trail to guarantee legal and operational transparency.

Step-by-step filing workflow

The system is designed with future legal expansion in mind, supporting logs, export features, and data trails required by legal entities.

Real-time progress tracking

The platform saves form progress in real time, allowing users to switch devices or pause mid-session without losing data.