The finance industry is evolving rapidly, fueled by the rise and a broader adoption of AI in fintech sector. ML models offer data-driven insights that are redefining how we pay, borrow, invest, and save money: faster and with more personalization than ever before.

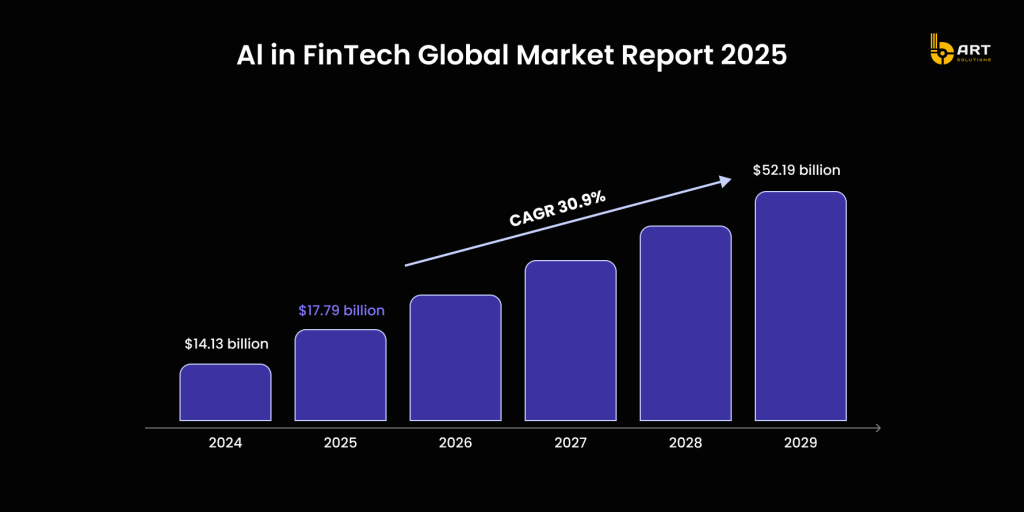

MarketsandMarkets research shows that the global market for AI in fintech was worth USD 8.3 billion in 2020 and is projected to grow to USD 18 billion in 2025, hitting CAGR of 30.9%. That’s not just a statistic; it’s an indicator of how much tech-driven innovation matters in modern finance.

Banks, payment startups, and traditional financial institutions alike are embracing AI to detect fraud, approve loans, and deliver hyper-personalized services.

A McKinsey Global AI Survey found that 56% of financial organizations already use AI in at least one business function.

The driving forces behind AI in fintech

- AI fuels smarter decision-making

Machine learning algorithms are becoming more advanced, enabling financial systems to process huge amounts of complex data. It results in more accurate risk assessments, fraud detection, and predictive analytics that support real-time financial decisions. - Data is the new currency

Fintech industry generates enormous amounts of data every day, and AI thrives on it. With access to structured and unstructured financial information, AI models extract valuable insights, helping institutions optimize lending, investments, and customer retention strategies. - Hyper-personalization for customer engagement

One-size-fits-all banking is long gone. Now customers expect tailored experiences from AI-driven financial advice to automated taxes and wealth management. Fintech companies utilize AI to analyze customer behavior and deliver personalized recommendations. - Regulators are catching up

Regulatory bodies are introducing frameworks that encourage responsible AI adoption while mitigating risks. This creates a more structured and beneficial environment for AI-driven fintech solutions.

Still, AI implementation in fintech presents significant challenges from data privacy rules to ethical concerns.

Fintech companies are tapping into AI development outsourcing to get help from professional teams that know AI integration in paytech inside and out. Partner with bART Solutions to integrate AI quickly, avoid pitfalls, and keep costs in check.

Let’s explore the most common bottlenecks that pop up when integrating AI in fintech, and see how outsourcing software development helps turn hurdles into a stepping stone.

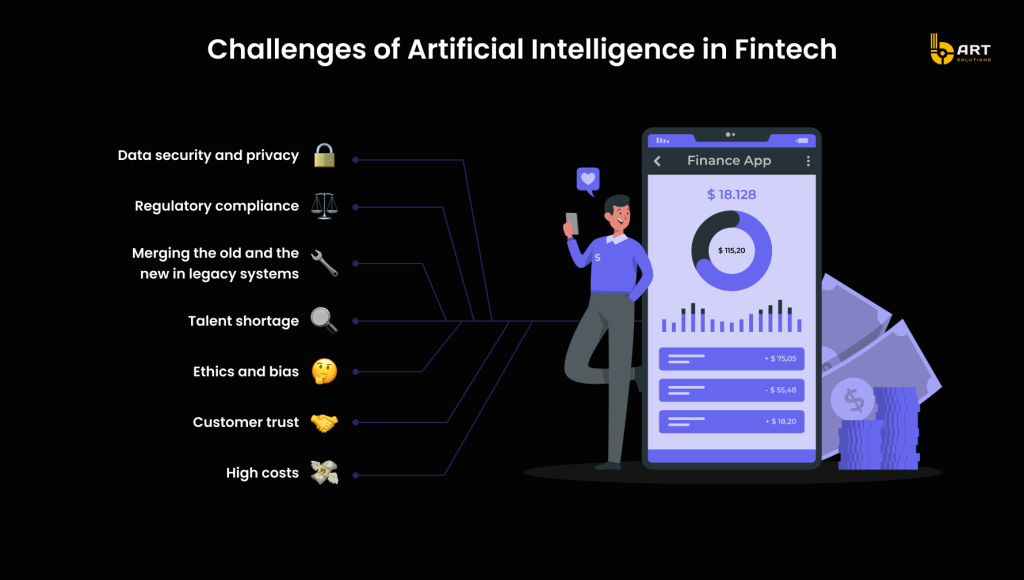

AI challenges in fintech and how to overcome them

Data security and privacy

If there’s one thing no bank or payment platform can afford to mess up, it’s data security. The trust factor hinges on how well they sensitive financial information. And here’s where AI’s dependency on vast amounts of data becomes a double-edged sword: comprehensive datasets are needed to train the models, but it’s also an attractive target for cybercriminals.

A 2024 report by IBM shows that the average data breach in the financial sector costs around 4.88 million.

Regulations like GDPR and PSD2 also can slam companies with heavy fines if they misuse or fail to protect user data. The question is: how to extract the analytics without risking data leaks or hacks?

The question is: how to extract the analytics without risking data leaks or hacks? That’s where homomorphic encryption and differential privacy come into play. Homomorphic encryption, for example, allows AI algorithms to process data without decrypting it, keeping sensitive details locked away. Some of the world’s largest tech players, including IBM and Microsoft, are actively investing and investigating this area.

Outsourcing AI development provides a direct route to experts who’ve done it before. bART Solutions development team is certified in major security standards and knowledgeable in AI and fintech data security regulations.

Regulatory compliance

In fintech AI regulatory compliance means that the models must be auditable, transparent, and fair. The FCA in the UK, for instance, keeps a close eye on how AI-driven platforms make credit decisions, and in the U.S., regulators come knocking if they detect discriminatory lending patterns.

A 2023 PwC survey of global financial institutions found that 57% of executives mention regulatory compliance as one of the top obstacles to expanding AI initiatives.

Explainable AI, often called XAI, where tools like LIME (Local Interpretable Model-Agnostic Explanations) or SHAP (SHapley Additive exPlanations) help everyone, including finance regulators understand why an algorithm made a specific choice. It’s critical for the cases when AI denies a loan or flags a transaction as fraudulent; customers and regulators usually demand to know why.

Outsourcing AI development can minimize compliance risks and prevent fintech companies stumbling into legal trouble.

Merging the old and the new in legacy systems

Many banks and established financial players rely on tech infrastructure designed decades ago. Legacy systems might be stable and familiar tools, but they don’t work well with modern AI frameworks. And yet, these platforms handle critical tasks like storing account balances or executing daily settlements, so legacy bottlenecks in payment systems can’t be just ignored.

A study discovered that 43% of banks see legacy systems as a huge barrier to digital transformation.

It’s one thing to build a modern AI-powered recommendation engine; it’s another to make it connect seamlessly with an outdated core mainframe. The optimal solution involves layering microservices, APIs, or containerization platforms like Docker and Kubernetes around the old system, incrementally modernizing data flows without changing the entire system at once.

This is where outsourcing becomes almost a silver bullet. Software development companies like bART Solutions who specialize in AI integration with legacy systems have run into these constraints repeatedly. They spot potential conflicts early, suggest flexible microservices architecture, or set up orchestration tools like Apache Kafka. This approach minimizes service disruptions for customers.

Talent shortage

According to LinkedIn’s “Jobs on the Rise 2023” list for the United States, positions related to artificial intelligence and machine learning remain among the fastest-growing. For instance, Machine Learning Engineer ranks prominently, reflecting continued high demand for AI-centric expertise.

Tech giants are scooping up data scientists with massive salaries and perks, leaving smaller companies struggling to stay competitive. For a growing startup or even a mid-size business, that can lead to hiring difficulties and unsustainable payroll costs.

By outsourcing AI development services for financial companies, you can find a team of experts and easily scale up or down as the project needs change. This results in a more streamlined operation and the ability to pivot quickly, which is essential in a sector where things shift at a moment’s notice.

Ethics and bias

Imagine discovering that a lending algorithm is skewing credit approvals against a certain demographic, or that a fraud detection tool unfairly flags transactions from customers in specific regions. These scenarios showcase ethical concerns: an AI system can reinforce biases that already exist in historical data which is especially harmful in fintech. Back in 2019, Apple’s credit card faced major backlash when some users claimed they got different credit limits based on gender, even when financial profiles seemed similar. Whether or not the algorithm truly discriminated, the controversy damaged consumer trust.

Overcoming bias in fintech applications requires both technical fixes, like adversarial debiasing or fairness-aware AI algorithms, and a strong organizational culture that values inclusion. Compliance truly goes beyond just the law; it involves making sure your brand aligns with responsible, ethical AI solutions in financial technology.

That’s easier said than done. Outsourcing teams, like ours, can help businesses set up systematic ways to audit data, measure fairness, and continually monitor model outputs.

Customer trust

Even the best AI solutions for fintech fall flat if customers aren’t willing to use them. Banking and payments are personal domains, involving individuals’ hard-earned money and sensitive data. Sometimes, people worry that a chatbot or algorithm can’t understand their unique situation the way a human adviser does, or they fear that AI might lose or misuse their information.

Recent data shows that 49% of banking customers feel uneasy about the security and transparency of AI-based systems.

At the same time, many customers genuinely enjoy the perks. Bank of America’s AI assistant, Erica, hit over 100 million client interactions in two years which shows that many are happy to turn to AI if it’s convenient and reliable.

Customer trust and clarity of fintech AI solutions go a long way. Explainable models, clear disclaimers about data usage, and an option to connect with a human agent whenever needed can ease doubts. Outsourcing AI development from partners with experience in AI-based customer service for paytech can help finding the right mix of automation and personal touch.

High costs

AI solutions for paytech deliver massive value boosting fraud detection, improving loan decisions, and providing personalized customer service. But it’s also an expensive undertaking. The price tag for infrastructure, licenses, specialized staff, and continuous R&D can spike fast, especially if you handle everything internally.

Research predicts that worldwide spending on AI systems could surpass USD 20 billion in 2025. And that figure isn’t limited to big banks; smaller fintech startups also shoulder part of the burden as they rush to keep up with evolving demands.

One increasingly common solution is cloud-based AI. Rather than purchasing and maintaining servers, fintech companies rent space on AWS, Azure, or Google Cloud, paying only for what they use. With pre-built AI libraries and open-source frameworks like PyTorch or TensorFlow, this infrastructure scales with business growth.

How outsourcing AI helps fintech companies handle costs is, at heart, about efficiency. Established vendors have the infrastructure and expertise already set up, so they lower the barrier to cost-effective AI adoption for fintech startups that want to move fast.

Wrap up

Navigating AI integration in paytech may seem full of hardware constraints, and ethical dilemmas. Data security must come first, compliance issues never go away, legacy systems resist change, talent is scarce, biases might lurk in sensitive data, and even the best technology won’t fly if customers don’t trust it.

The upside is that there’s a clear path forward if you consider outsourcing AI development for financial services. Relying on experts like bART Solutions allows you to accelerate development with minimum risks. Pro teams have walked the same path many times over, so they know how to spot pitfalls before you hit them. They also provide flexible engagement models, allowing you to scale up or down as projects evolve.

This results in a synergy of external expertise and internal vision. You bring the market knowledge, strategic goals, and brand direction; the outsourcing partner brings deep domain expertise, well-rehearsed development practices, and compliance-savvy processes. Together, you can handle AI integration with legacy systems, implement robust AI regulatory compliance in fintech, build fair algorithms, and develop solutions that meet customers’ needs.

As the fintech industry tends to a more data-driven future, the real winners will be those who understand that AI is not just about technology. It’s about implementing AI seamlessly into every layer of financial services, secured by smart data practices, guided by clear ethics, supported by the right talent, and delivered with transparency that fosters confidence.

AI challenges in fintech are actually markers of a change that transforms finance as we know it. Contact us today to be at the forefront of this transformation.