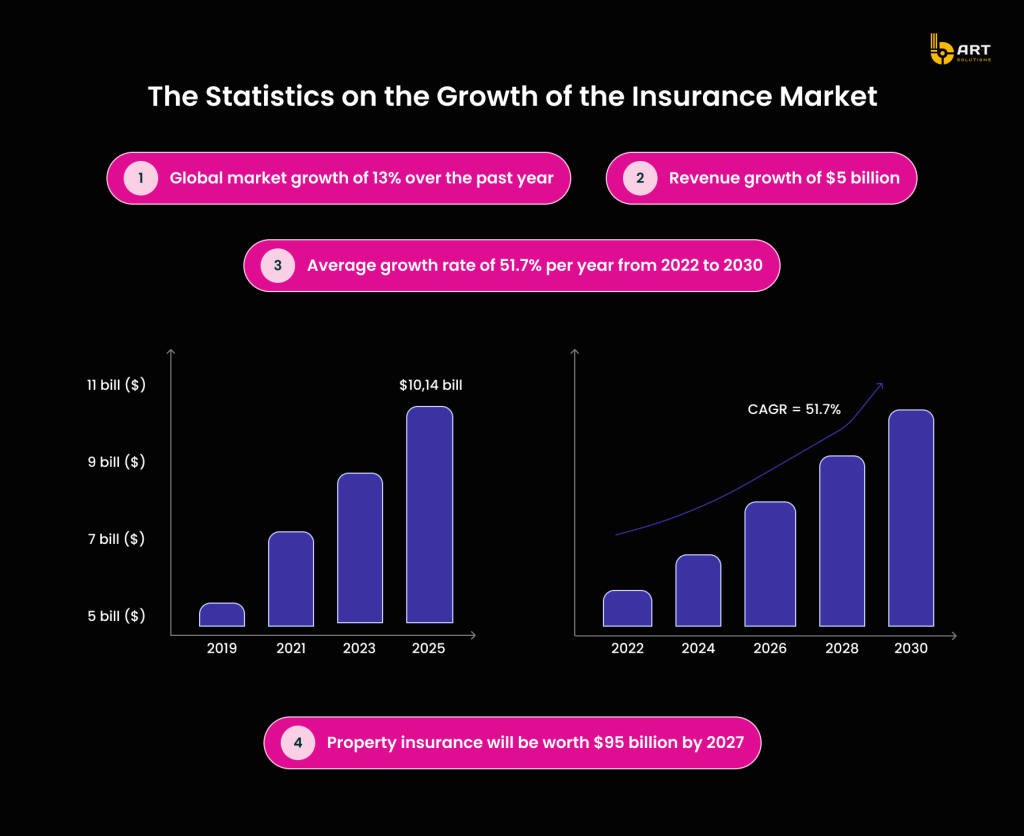

The Insurtech industry, which merges insurance and technology, is rapidly growing and transforming the business landscape. The global Insurtech market is expected to nearly double, reaching $10.14 billion by 2025, with continued growth anticipated in the years beyond.

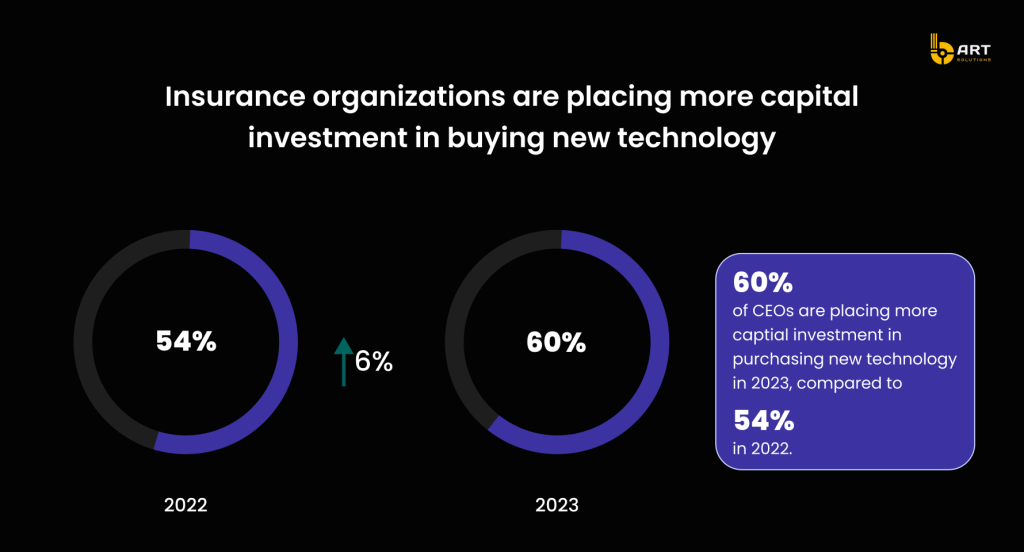

The strategic focus on digital solutions is evident in the priorities of insurance CEOs. Advancing the digitization and connectivity of operational areas is the top priority for 25% of them, ahead of improving customer experience (19%) and enhancing employee value proposition (18%).

Strategic Importance of Insurance Software Development

Insurers are increasingly utilizing custom solutions with a range of advanced technologies to improve their services.

Artificial intelligence (AI) is fundamental for refining risk assessment and premium calculations. AI’s ability to analyze extensive datasets allows for more accurate underwriting and pricing.

AI-driven chatbots are improving customer service by offering immediate assistance, handling claims, and providing tailored policy advice.

Blockchain technology is enhancing transparency and security in transactions. By providing a decentralized and immutable ledger, blockchain ensures data integrity and helps prevent fraud, thereby increasing trust among customers.

The Internet of Things (IoT) is another pivotal technology in insurance software development, enabling companies to collect real-time data from various connected devices. This data can be used for personalized insurance offerings and proactive risk management. For instance, telematics devices in vehicles monitor driving behavior, allowing insurers to offer usage-based insurance policies.

Emerging Trends in Insurance Customer Experience

In today’s market, flooded with custom insurance software, delivering a superior customer experience is vital, especially with numerous options available on the market.

Key trends reshaping customer experience in the insurance industry

Personalization

Faced with an overwhelming amount of choices and information, people desire personalized recommendations. Tailored suggestions help simplify decision-making and increase response rates to targeted discounts and offers.

Omnichannel Experience

Modern consumers expect a consistent experience across various channels, including websites, mobile apps, social media, and call centers.

Self-Service Options

There is a growing demand for 24/7 access to services such as payments, claims filing, policy adjustments, and information access. These self-service options need to be user-friendly and supported by digital tools like virtual assistants and chatbots, alongside 24/7 customer support.

Streamlined Claims

The claims process is often a stressful time for clients. Simplifying this procedure and maintaining clear communication strengthen relationships during critical moments.

Embedded Insurance

Bundling insurance with other goods and services at the point of sale simplifies the purchasing process. However, retaining these clients requires personalized communication strategies to encourage repeat business.

Business Impact of Insurance Software

Streamlining Operations

Insurance software automates and optimizes various operational processes, making them more efficient and less prone to errors. Key areas impacted include:

- Underwriting: Advanced algorithms and machine learning models can assess risk factors and determine premiums with greater accuracy and speed. This reduces the time needed for manual underwriting and minimizes human error.

- Claims Processing: Automated claims processing systems expedite the evaluation and settlement of claims. By using AI to review documentation and detect anomalies, these systems ensure faster and fairer claim resolutions.

- Policy Management: Software platforms allow for seamless policy management, from issuance to renewal. Customers can easily access and update their policies online, reducing the administrative burden on insurance firms.

Reducing Costs

By streamlining operations, insurance software also contributes to significant cost savings. Here are some ways it achieves this:

- Automation: Automating routine tasks such as data entry, document processing, and customer communications reduces the need for extensive human labor, thereby cutting labor costs.

- Operational Efficiency: Enhanced process efficiency leads to reduced overhead costs. For example, faster claims processing reduces the time and resources spent on managing each claim, resulting in lower operational expenses.

- Data-Driven Insights: Insurance software provides valuable data analytics that help companies identify cost-saving opportunities. Predictive analytics can forecast trends and risks, enabling firms to allocate resources more effectively and avoid unnecessary expenditures.

Improving Service Delivery

Insurance software enhances service delivery by making the customer experience smoother and more personalized. Key benefits include:

- Enhanced Customer Interaction: Digital platforms offer multiple touchpoints for customer interaction, including mobile apps, web portals, and chatbots. This ensures customers can access services and support at their convenience.

- Personalization: AI-driven personalization engines can analyze customer data to offer tailored recommendations and services. Personalized insurance plans and targeted offers increase customer satisfaction and loyalty.

- Transparency and Communication: Automated communication systems keep customers informed about their policy status, claims progress, and any changes. This transparency builds trust and ensures clients are always up-to-date.

Data-Based Decision-Making

Insurance software leverages cutting-edge technology and data analytics to support informed decision-making. Benefits include:

- Risk Assessment: Advanced data analytics tools analyze vast amounts of data to provide accurate risk assessments, leading to better underwriting decisions.

- Fraud Detection: AI-powered algorithms can identify patterns indicative of fraud, helping to prevent fraudulent claims and ensuring fairness.

- Customer Insights: Data analytics provide deep insights into customer behavior and preferences, allowing insurers to develop products and services that better meet client needs.

Innovative Insurance Ideas

With the help of advanced software, insurance companies can innovate and expand their offerings:

- New Product Development: Data insights and predictive analytics help in developing new insurance products that cater to emerging customer needs and market trends.

- Embedded Insurance: Integrating insurance products with other services at the point of sale, such as travel or event tickets, offers a convenient and seamless experience for customers.

Expanding Insurance Coverage

Insurance software extends the reach of insurance services to underserved areas:

- Digital Platforms: Mobile apps and online platforms make it easier for people in remote or underserved locations to access insurance services.

- Inclusive Products: Tailored insurance products that cater to specific needs of diverse customer segments ensure wider coverage and protection.

A reliable custom insurance software provides a critical competitive advantage by enabling companies to offer unique, tailored services that meet specific client needs. This differentiation helps attract and retain customers who value personalized solutions.

Exploring Different Types of Insurance Apps

Car Insurance Apps

For car insurance companies, focusing on the development of apps that simplify the aftermath of accidents and enhance the overall driving experience is essential.

Accident Documentation: Users can quickly capture accident details, including photos, videos, and notes, ensuring accurate and comprehensive records.

Claims Filing: Streamlined processes allow for quick and easy filing of claims directly through the app, reducing the time and hassle traditionally associated with such procedures.

Repair Estimates: Tools are provided to obtain repair estimates, either by connecting with partner repair shops or using integrated estimation tools.

Driving Improvement: Features like driving behavior analysis and feedback help users improve their driving skills and potentially lower their insurance premiums.

Health Insurance Apps

Health insurance app development is aimed to simplify the often complex process of managing healthcare services and policies.

Policy Navigation: These apps break down complex terms and coverage details into easily digestible information, helping users understand their health insurance policies.

Physician Finder: Users can locate in-network physicians and specialists, ensuring they receive care covered by their insurance.

Appointment Scheduling: Many apps facilitate scheduling and managing appointments with healthcare providers, streamlining the process and reducing wait times.

Price Comparison: Tools are available to compare prices for health plans, medications, and services, enabling users to make informed decisions and potentially save money.

Claims Management: Simplified claims submission and tracking help users efficiently manage their health expenses.

Life Insurance Apps

Custom life insurance software development services offer valuable tools for policyholders to manage their life insurance policies effectively.

Policy Selection: Users can compare different life insurance policies, helping them choose the one that best fits their needs and financial situation.

Servicing: These apps allow policyholders to update their information, change beneficiaries, and make other necessary adjustments to their policies.

Payment Processing: Simplified payment options ensure that premiums are paid on time, avoiding lapses in coverage.

Customer Support: Integrated customer support features provide users with assistance and answers to their questions, improving overall satisfaction.

Travel Insurance Apps

Travel insurance apps minimize the risks associated with traveling by offering comprehensive coverage and support for various travel-related incidents:

Medical Emergencies: Coverage for medical emergencies ensures that travelers can receive necessary medical care without incurring significant out-of-pocket expenses.

Medical Transport: Support is provided for arranging medical transportation in case of serious health issues while traveling.

Lost Baggage: Users can quickly report and track lost baggage claims, facilitating prompt resolution and compensation.

Travel Documents: Coverage for lost or stolen travel documents helps travelers replace essential items like passports, reducing stress and inconvenience.

Coverage Options: These apps offer flexible coverage options, including automatic coverage while traveling between countries and pay-per-day insurance plans.

Property Insurance Software

Property insurance apps are invaluable tools for real estate investors and property owners, helping to mitigate various risks associated with property ownership:

Risk Management: Tools are provided to assess and manage risks related to property damage from disasters, theft, vandalism, or fire.

Claims Filing: Streamlined claims processes allow users to quickly report incidents and track the status of their claims, ensuring timely resolution and compensation.

Policy Management: Users can easily manage their property insurance policies, including updating information and making necessary changes.

Coverage Details: Comprehensive information about coverage limits and exclusions helps users understand their policies and make informed decisions.

Business Insurance Apps

Business insurance software protect companies from various threats and uncertainties, providing comprehensive coverage for different aspects of a business:

Policy Coverage: Detailed information about coverage for buildings, equipment, inventory, and furniture helps business owners understand their protection.

Risk Assessment: Tools for assessing potential risks and vulnerabilities allow businesses to take proactive measures to minimize threats.

Claims Management: Simplified claims filing and tracking processes ensure businesses can quickly recover from property loss or damage due to natural disasters, theft, or vandalism.

Operational Support: Many apps provide additional resources and support for managing business operations, enhancing overall efficiency and resilience.

bART Solutions has developed an innovative insurance app that showcases the potential insurTech. See the case study to learn more about this app and its impact.

Core Features of a Successful Insurance App

User Onboarding

By simplifying registration and providing clear, guided steps, the app enhances user experience right from the start. This can include social media logins, minimal form fields, and a smooth user interface that guides new users through the necessary steps to get started.

Policy Management

Users should be able to view, buy, and manage their policies with ease. This includes accessing policy details, renewing or upgrading policies, and making any necessary changes to their coverage.

Claims Processing

An effective app should allow users to file claims easily, track the status of their claims in real-time, and receive notifications about claim updates. This reduces the time and effort involved in traditional claims processing and enhances overall user satisfaction by providing a hassle-free experience.

Customer Support

Integrated customer support features, such as chatbots and support ticket systems, are essential for round-the-clock service. These tools enable users to get help whenever they need it, whether it’s through automated responses for common queries or the ability to connect with a live agent for more complex issues.

Data Analytics

By analyzing user interactions and feedback, insurers can identify trends, understand customer needs, and make data-driven decisions to enhance their services. This helps in tailoring products and features to better meet user demands.

Security Features

Successful insurance app development prioritizes security features such as data encryption, secure login mechanisms, and fraud detection systems. These measures protect sensitive information from unauthorized access and cyber threats, ensuring users feel confident and secure while using the app.

If you want to develop an insurance app with all these advanced features, contact our team at bART Solutions for expert assistance.

Advanced Features to Consider for Enhancing Insurance Apps

AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the insurance industry by providing powerful tools for predictive analytics, personalized insurance offerings, and enhanced risk assessment.

Predictive Analytics: AI analyzes vast amounts of data to predict future trends and potential risks, allowing insurers to anticipate claims, adjust premiums, and improve overall risk management.

Personalized Insurance Offerings: ML algorithms evaluate individual customer data to create tailored insurance plans that meet specific needs, increasing customer satisfaction and retention.

Risk Assessment: AI-powered tools assess risk with greater accuracy by analyzing various factors, such as driving behavior, health data, and environmental conditions, leading to precise underwriting and fairer pricing.

Internet of Things (IoT)

The integration of IoT devices provides real-time data that enhances various types of insurance, particularly health and automotive insurance.

Health Insurance: Wearable devices like fitness trackers and smartwatches monitor health metrics such as heart rate, physical activity, and sleep patterns. Insurers use this data to offer personalized health plans and incentivize healthy behavior.

Automotive Insurance: Connected cars equipped with IoT sensors provide data on driving habits, vehicle usage, and maintenance needs. This information supports usage-based insurance (UBI) policies, where premiums are based on actual driving behavior, promoting safer driving habits.

Blockchain

Blockchain technology offers robust solutions for claims management and fraud prevention, enhancing transparency and security.

Claims Management: Blockchain streamlines the claims process by providing a transparent and immutable ledger for all transactions, ensuring all parties have access to the same information, reducing disputes, and speeding up claim settlements.

Fraud Prevention: The decentralized nature of blockchain makes it difficult for fraudulent activities to go undetected. Each transaction is recorded and cannot be altered, making it easier to verify the authenticity of claims and detect any anomalies.

How Much Does It Cost to Build an Insurance App?

General Cost Estimate

The cost of developing an insurance app can range from $30,000 to $500,000 or more. This broad range is influenced by the specific requirements and scope of the project. Here are some key factors that affect the cost:

Key Cost Factors

App Design

The design complexity, including user interface (UI) and user experience (UX) elements, significantly impacts the cost. Custom designs and intricate animations will increase expenses.

Number of Features

The more features an app has, the higher the development cost. Basic features might include policy management, claims processing, and customer support, while advanced features could involve AI integrations, real-time data analytics, and blockchain for security.

Backend Development

Building a robust backend to handle data storage, user authentication, and server-side logic is crucial. The complexity and scalability requirements of the backend will influence the cost.

Third-party Integrations

Integrating third-party services, such as payment gateways, CRM systems, or external APIs for data enrichment, can add to the overall cost.

Number of Platforms

Developing for multiple platforms (iOS, Android, Web) will increase costs compared to building for a single platform. Cross-platform development can be a cost-effective solution but may not fully leverage each platform’s native capabilities.

Maintenance and Updates

Ongoing maintenance and regular updates are necessary to keep the app secure, bug-free, and compatible with new OS versions. This requires a continuous investment post-launch.

Additional Considerations

- Development Approach: Choosing between in-house development and outsourcing to a specialized app development company or remote developers will impact costs. Outsourcing can be more cost-effective and provide access to a broader talent pool.

- Geographic Location: Development costs vary by region, with developers in North America and Western Europe generally commanding higher rates than those in Eastern Europe, Asia, or South America.

- Timeline: The overall development timeline affects costs, with longer projects requiring more resources and potentially higher expenses.

To obtain a precise cost estimate tailored to your specific needs, it is advisable to consult with an expert insurance app development company. They can provide a detailed breakdown of costs and services required for your project.

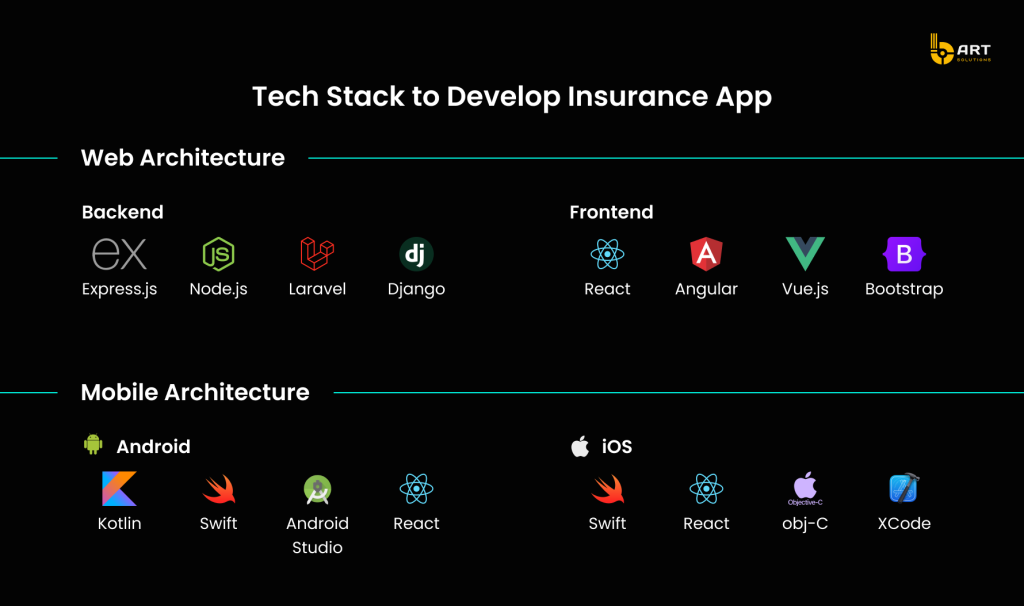

Choosing the Right Tech Stack

In the insurance app development process, selecting the right technology is crucial for minimizing the development time and costs. Leveraging effective services and solutions will ensure a high-quality final product.

Consulting with experienced professionals and staying updated with the latest technology trends can enhance your decision-making, ensuring your insurance app is built on a robust and efficient foundation.

Essential Steps of Custom Insurance Software Development

To gather initial customer feedback and validate your concept, it’s recommended to start with a Minimum Viable Product (MVP). Once the MVP gains traction in the market, you can then transition to a fully-fledged application.

1. Discovery Phase

The discovery phase entails an in-depth analysis, defining the overall development process. During this phase, the development team creates a blueprint of developmental activities, sets milestones, and outlines the major app features to be integrated. The goal is to ensure all team members understand the expected deliverables and to make informed choices that align with the brand’s voice.

Key processes in the discovery phase:

- Market Analysis: Understanding the target market’s needs and preferences.

- Competitor Analysis: Identifying strengths and weaknesses of existing solutions.

- Cost Analysis: Estimating the budget required for development and deployment.

2. Design Phase

The design phase involves conceptualizing how the app will look and function. Starting with a design prototype helps in adjusting user flows and serves as a guide during development. A product prototype can also act as an elevator pitch for investors.

Using the blueprint from the discovery phase, designers focus on:

- UX Wireframe: Outlining the user experience and navigation flow.

- UI Design: Creating the visual design for different app screens.

- Clickable App Design: Developing a working prototype to demonstrate functionality.

- Collaborative Design File: Ensuring all stakeholders can review and provide feedback.

3. Development and Testing Phase

This phase transforms the UI/UX design into a functional solution. A project manager oversees the process, establishing milestones to ensure adherence to guidelines and timelines.

After completing development, quality assurance engineers conduct a series of tests to ensure the app’s overall security and stability.

Key activities include:

- Backend Development: Setting up the server, database, and application logic.

- Frontend Development: Building the user interface and integrating with the backend.

- Quality Assurance: Performing functional, performance, and security testing.

4. App Deployment and Maintenance

Post-launch, prioritizing user feedback is crucial. Studying and applying user feedback helps in making rapid improvements and updates.

Key steps in this phase:

- Deployment: Publishing the app on relevant app stores.

- User Feedback: Collecting and analyzing feedback to identify areas for improvement.

- Maintenance and Updates: Continuously updating the app to fix bugs, add new features, and enhance performance.

By following these structured phases, you can develop a successful insurance mobile app tailored to your business needs. Consult with an experienced team for a more detailed breakdown.

Choosing the Right Development Partner

Choosing the right software development firm is crucial for the successful launch of your insurance app. Here are some key criteria to consider when evaluating potential partners:

Experience

A tech partner with extensive experience in insurance software development brings invaluable insights and skills to your project. Look for partners who have:

- Years of Industry Experience: Companies that have been in the business for several years are more likely to have refined their processes and methodologies.

- Technical Expertise: Ensure they are proficient in the latest technologies and development practices relevant to your project.

Past Projects

Reviewing insurance projects of a software development service company provides a clear picture of their capabilities and success in delivering similar solutions. Key aspects to consider include:

- Portfolio: Examine their portfolio to see if they have developed apps similar to your vision.

- Case Studies: Look for detailed case studies that highlight their problem-solving approach, the technologies used, and the outcomes achieved.

- Client Testimonials: Positive feedback from previous clients can indicate reliability and satisfaction.

Industry Expertise

A tech partner with specific expertise in the insurance industry will better understand your needs and challenges. Consider their:

- Domain Knowledge: Familiarity with insurance regulations, market trends, and customer expectations.

- Relevant Solutions: Experience in developing InsureTech solutions that address common industry problems.

Engagement Models

Understanding the different engagement models can help you choose the best approach for your project. Here’s a comparison of the most common models:

Fixed Price

In the fixed price model, the cost and timeline for the project are agreed upon upfront. This model is suitable when:

- Requirements Are Clear: The project scope, features, and deliverables are well-defined.

- Budget Constraints: You have a fixed budget and want to avoid cost overruns.

- Short-Term Projects: The project duration is relatively short, reducing the risk of scope changes.

Pros:

- Predictable costs

- Defined timeline

- Less project management effort

Cons:

- Inflexible to changes

- Potential for scope creep if requirements are not clearly defined initially

Time and Material

The time and material model charges based on the actual time and resources spent on the project. This model is ideal for:

- Evolving Requirements: Projects where the scope may change or evolve over time.

- Long-Term Projects: Development is expected to continue for an extended period, with regular updates and iterations.

Pros:

- Flexibility to adapt to changes

- Transparency in billing

- Suitable for complex projects

Cons:

- Less cost predictability

- Requires close monitoring and management

Dedicated Team

In this model, a dedicated team of developers works exclusively on your project. This approach is best when:

- Continuous Development: Ongoing development and support are required.

- Full Control: You need full control over the development process and priorities.

- Scalability: The ability to scale the team up or down based on project needs.

Pros:

- High flexibility and control

- Direct communication with the team

- Ability to quickly adapt to changes

Cons:

- Higher management overhead

- Potentially higher costs compared to fixed price for short-term projects

Summary

Developing custom software offers numerous benefits to insurance companies, including revenue growth, expanded customer base, reduced operational costs, and enhanced business efficiency.

If you are seeking a team to develop a bespoke app for your insurance company, consider reaching out to bART Solutions. With 50+ professionals on board and seven years of experience in software development, bART Solutions can provide a tailored solution to meet your needs.