The legal and regulatory sectors face significant challenges, including complex frameworks and increasing compliance demands. A Wolters Kluwer study found that 72% of legal professionals struggle with regulatory complexity, while Deloitte reports that financial institutions spend up to 10% of revenue on compliance. These issues slow down operations and increase costs.

AI in Legaltech and Regtech addresses these challenges by automating document management, improving compliance monitoring, and enhancing risk management. Through AI-driven solutions, businesses can streamline processes, reduce errors, and stay compliant more efficiently.

Let’s explore how AI innovations are reshaping these sectors.

AI streamlining the complexities of regulatory compliance

Navigating regulations such as GDPR, AML, and HIPAA is a difficult task for legal and financial institutions. Such regulations vary across jurisdictions but also frequently change, making compliance a costly and resource-intensive process.

In 2023 alone, regulatory non-compliance led to $15 billion in fines for financial institutions.

One of the most significant innovations in Regtech AI compliance is the ability to automate monitoring and integrate these regulatory updates into internal systems. AI-powered tools can scan a variety of global regulations, ensuring institutions remain compliant with both local and international laws.

AI-powered compliance tools in action

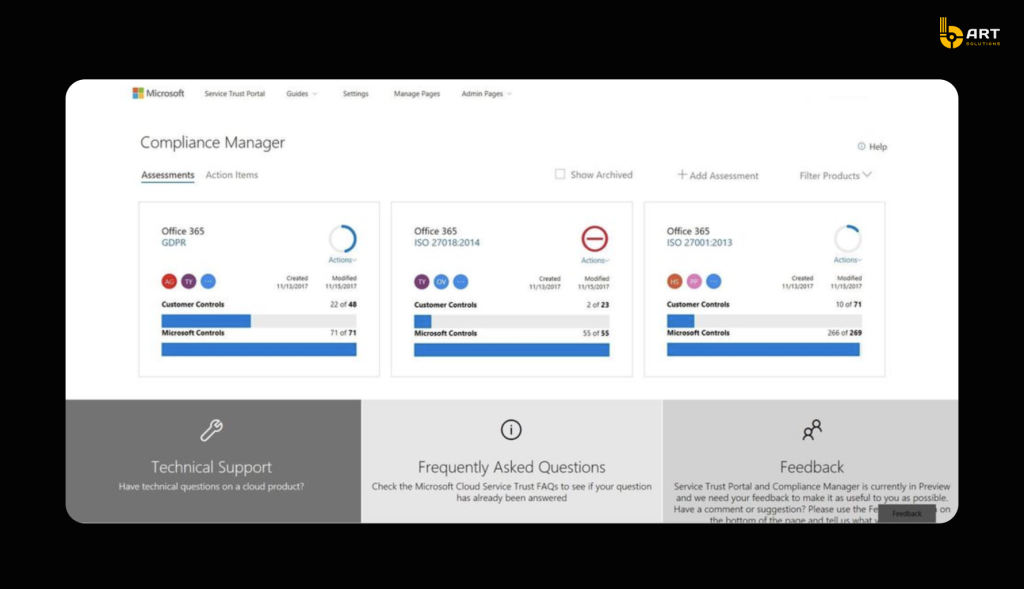

Microsoft Compliance Manager is one example of an advanced tool designed to help companies manage compliance efficiently. This solution leverages AI-powered regulatory monitoring to assess an organization’s compliance status in real time. It provides actionable insights by offering a detailed breakdown of compliance risks, giving companies the ability to address these issues proactively. With features like automated documentation and a risk-based dashboard, Microsoft Compliance Manager ensures that businesses stay ahead of regulatory changes without significant manual effort.

Another standout feature of Microsoft Compliance Manager is its integration with cloud-based systems, allowing it to automatically assess data from various services and check them against regulations like GDPR or CCPA. The tool provides compliance scores, identifies gaps in the organization’s current practices, and offers recommendations on how to resolve compliance issues. The platform supports continuous auditing, allowing companies to ensure ongoing compliance across multiple departments without frequent manual audits.

Another tool making waves in the industry is JPMorgan’s COIN (Contract Intelligence). This AI-driven system automates the review of contracts and legal documents to ensure they meet regulatory standards. COIN analyzes legal agreements and identifies potential compliance issues in a fraction of the time it would take human lawyers. By automating contract analysis, COIN can review 12,000 contracts in just a few seconds, a task that would typically require 36,000 hours of manual work.

This system greatly reduces the time and costs associated with contract compliance, while also improving accuracy.

These tools showcase a growing trend for AI for legal document verification and AI-powered legal data analysis, which are becoming essential in maintaining regulatory compliance in both the legal and financial sectors.

AI-powered document automation

Document automation in the legal industry becomes powered by AI solutions. Traditionally, legal professionals spend hours reviewing and managing large volumes of documents, including contracts, compliance reports, and legal agreements. LegalTech AI transforms these workflows by automating critical tasks such as document generation, sorting, and review.

How AI document automation works

- Document creation: AI can auto-generate documents such as contracts or NDAs by using templates and predefined rules. This eliminates the repetitive nature of drafting legal documents from scratch, allowing legal teams to focus on high-value tasks.

- Document sorting and categorization: AI solutions for legal document sorting automatically classify documents based on type, regulatory requirements, or other criteria. This function improves efficiency by enabling faster retrieval of necessary files when needed.

- Document review and verification: AI contract verification tools cross-reference legal texts with a database of regulations, flagging any areas that need modification to remain compliant. This reduces the risk of oversight, especially in industries where regulations change frequently.

- Contract lifecycle management: AI also assists in managing contracts throughout their entire lifecycle, from creation to renewal or termination. Tools designed for AI tools for contract management can send alerts for upcoming deadlines, automate the negotiation process, and track compliance.

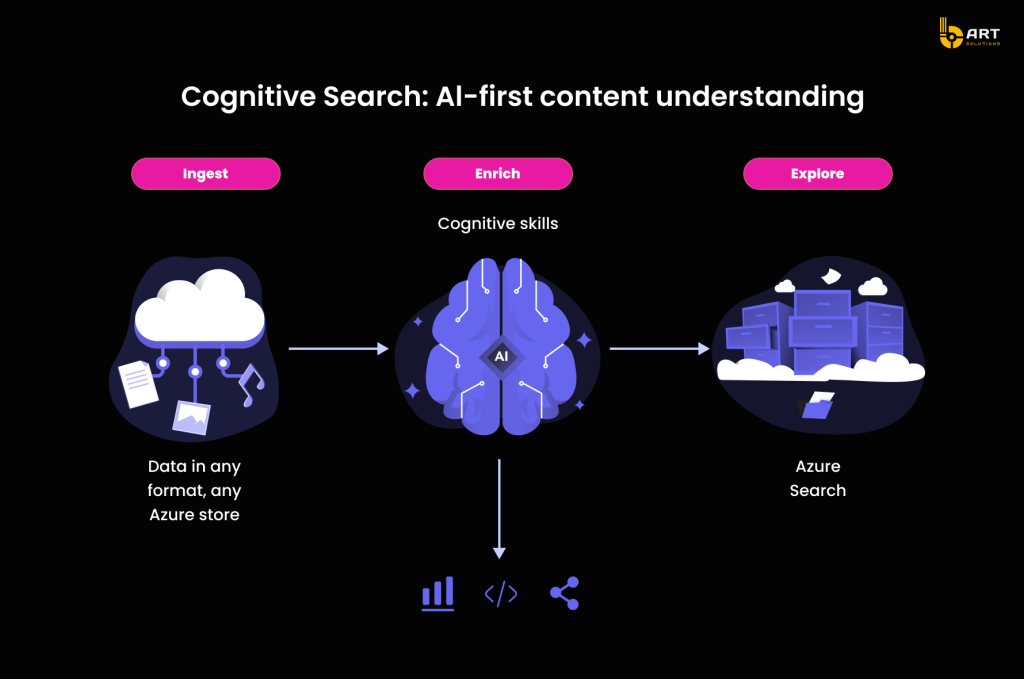

Azure Cognitive Search for document management

Azure Cognitive Search enhances document management by using AI-powered data indexing and search capabilities. It allows legal professionals to quickly search, sort, and retrieve large amounts of data from various document repositories. By utilizing AI for legal document storage and retrieval, legal teams can find specific documents or clauses within large legal databases, reducing the time spent manually searching through files.

Azure Cognitive Search also employs natural language processing to understand the context of the search query, delivering more relevant and accurate results. This feature is particularly beneficial in managing complex legal documents, where critical information might be hidden deep within large files. As a result, teams can respond to client requests faster and ensure that all relevant data is easily accessible for audits or compliance reviews.

Luminance AI for legal document automation

Another example of Legaltech AI document Automation is Luminance, an AI-driven platform designed for law firms and corporate legal departments. Luminance employs machine learning to assist with AI for document review, speeding up the process of due diligence, contract analysis, and regulatory reviews.

Slaughter and May, one of the global top law firms, uses Luminance to streamline its legal document review process during mergers and acquisitions (M&A). The company has reported a 50% reduction in time spent on document review.

Harnessing Azure AI for legal and financial innovation

Azure AI provides powerful, scalable solutions that are transforming the way legal and financial institutions operate. With a robust set of AI tools and machine learning models, Azure AI is enabling companies to overcome longstanding inefficiencies and meet evolving industry demands.

Document automation and management

Azure AI’s Cognitive Search and Form Recognizer are game-changers for document management. Azure Cognitive Search enables organizations to extract and categorize data from vast document repositories efficiently. Form Recognizer uses AI to extract text and key-value pairs from forms and legal contracts, further streamlining document management processes.

Enhanced compliance monitoring

Azure AI’s Compliance Manager helps businesses adhere to global standards like GDPR, AML, and HIPAA by automating risk assessments and compliance checks. AI monitors and tracks regulatory updates in real-time, ensuring organizations can adapt quickly.

Legal and financial risk management

Azure AI’s predictive analytics can assess and forecast potential legal and financial risks. For example, legal firms can use AI to analyze contract clauses and flag potential risks, while financial institutions use AI risk management tools to monitor market volatility and regulatory changes. By predicting risks before they materialize, Azure AI enables organizations to make informed decisions that protect them from legal disputes or financial losses.

Automation of legal research and data processing

One of the key benefits of Azure AI in the legal sector is the automation of legal research. Azure’s NLP models can quickly analyze large databases of case law, regulations, and previous rulings, allowing lawyers to streamline research efforts.

BakerHostetler, a U.S. law firm, uses Azure-based AI to handle research tasks, significantly improving the speed and accuracy of their work.

Scalability and security

Azure AI is built on a scalable cloud infrastructure that allows legal and financial institutions to grow their operations without over-provisioning resources. Its pay-as-you-go model makes it cost-effective for organizations of all sizes, from startups to large enterprises. Azure’s security features, including data encryption and identity management, ensure that sensitive legal and financial data is securely stored and managed, maintaining regulatory compliance.

AI integration is a game changer for legaltech and regtech

Managing compliance, legal documentation, and data is increasingly difficult for legal and financial institutions. Traditional approaches are no longer sufficient. AI integration is stepping in to automate repetitive tasks, enhance accuracy, and offer real-time insights. Below are some key benefits of AI integration, supported by relevant statistics.

Increased efficiency and automation

McKinsey estimates that the implementation of AI could automate up to 23% of a lawyer’s workload.

AI-powered legal document management systems automate document classification, sorting, and verification, reducing the workload for legal teams. In regtech, AI-driven compliance monitoring helps track and analyze evolving regulations in real time, reducing the manual burden on compliance officers.

Enhanced decision-making through data analysis

Gartner reports that organizations leveraging AI for decision-making see a 25% improvement in accuracy and responsiveness.

AI-driven legal research tools can analyze hundreds of documents in seconds, providing relevant case law, regulations, and precedents for better legal strategies. In the financial sector, AI can identify patterns in market data, helping financial institutions make more informed decisions regarding risk management and compliance.

Improved accuracy and reduced errors

A PwC report found that AI can improve accuracy in legal document reviews by up to 90%, ensuring fewer mistakes and more precise adherence to regulatory guidelines.

AI systems excel at identifying discrepancies, risks, or patterns that may be missed by human workers. AI contract verification ensures that contracts are reviewed for compliance, missing clauses, or errors, improving the accuracy and completeness of legal documents. AI compliance automation tools ensure that organizations stay compliant with the latest regulatory standards, reducing the likelihood of costly fines.

Scalability for growing operations

A Forrester report suggests that companies implementing scalable AI solutions see a 40% reduction in infrastructure costs due to the efficiency of cloud-based AI systems.

As businesses expand, AI systems can handle larger workloads, such as processing more legal documents or increasing the scope of compliance monitoring without the need for additional staff.

Cost savings

According to McKinsey, legal and compliance sectors adopting AI have seen cost savings of between 20-40% due to the reduction in manual labor and operational inefficiencies.

By automating routine tasks, AI significantly reduces labor costs. AI-driven legal document automation can cut down the number of hours spent on drafting and reviewing contracts, translating into significant cost savings for law firms. Regtech solutions that rely on AI-driven compliance monitoring reduce the need for large compliance teams and minimize the risk of expensive regulatory fines.

Strengthened security and compliance

AI enhances data security and ensures adherence to privacy regulations like GDPR, AML, and HIPAA. AI systems can continuously monitor data for compliance violations, ensuring that organizations meet legal and regulatory standards. AI-driven compliance monitoring also provides real-time updates, helping businesses respond promptly to new regulatory requirements and mitigate the risk of non-compliance.

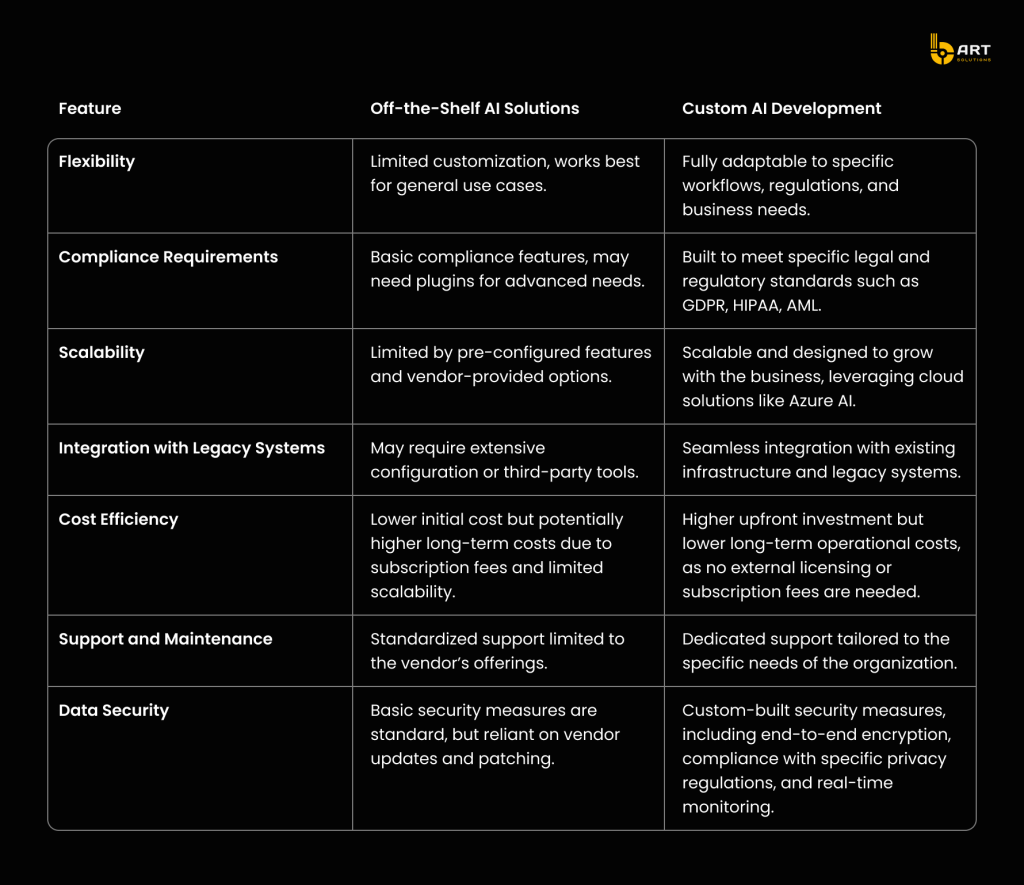

Off-the-shelf tools vs. custom AI solutions

When it comes to integrating AI, businesses are often faced with the decision of choosing between off-the-shelf AI tools or custom-developed solutions. Both options come with their advantages and drawbacks. Here’s a comparison highlighting why customized solutions are overall the better option.

Conclusion

The integration of AI into legaltech and regtech is reshaping how legal and financial companies operate. By automating complex tasks AI improves efficiency, reduces errors, and ensures regulatory adherence. Achieving the full potential of AI-driven solutions requires more than just adopting ready-made tools. Customized AI solutions are becoming crucial for meeting the specific needs of businesses, particularly in industries with complex regulatory frameworks like finance and law.

This is where partnering with experienced developers becomes essential. bART Solutions, with its team of certified Azure experts, offers a proven track record in delivering scalable, cloud-based AI solutions tailored to the specific needs of the industries.

Check out our latest project on an AI-based tax management platform, showcasing how we help companies streamline operations and stay compliant.